child tax credit 2021 dates and amounts

The first phaseout reduces the Child Tax Credit by 50 for each 1000 or fraction thereof by which the taxpayers modified AGI exceeds the income amounts above. For 2021 eligible parents or guardians.

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

Child Tax Credit Payments What S Next

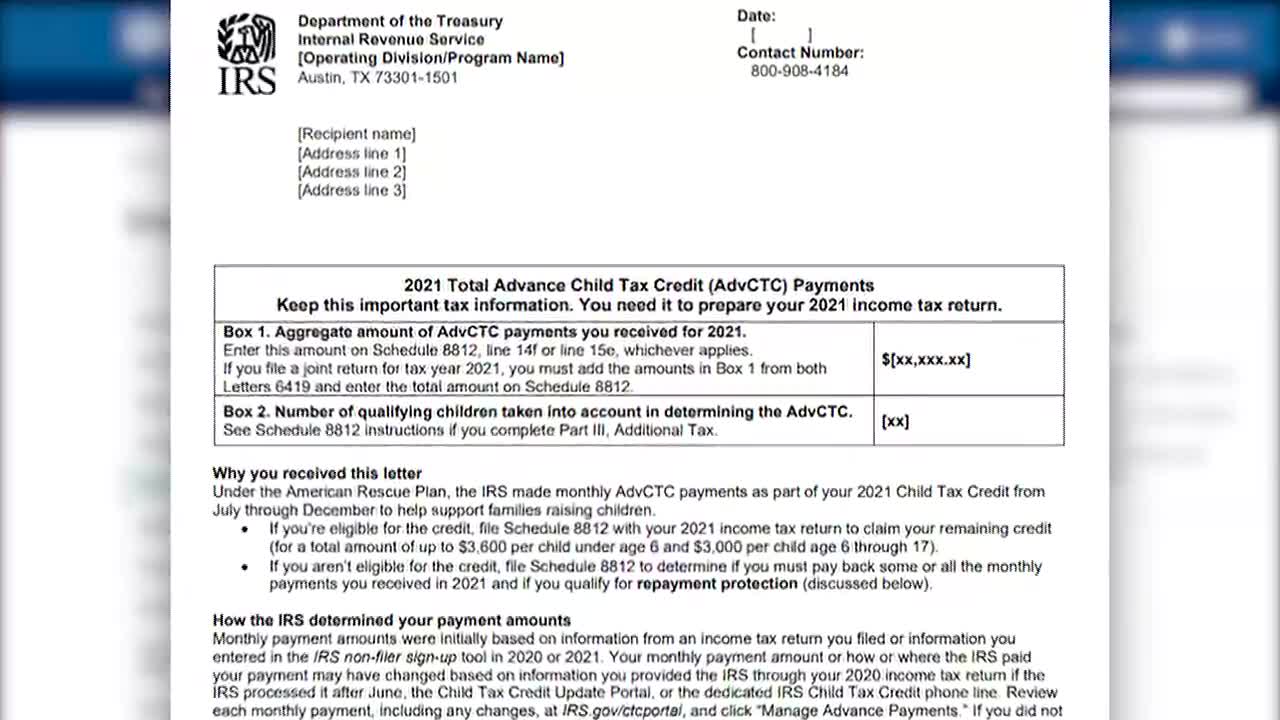

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

. 15 opt out by Aug. Your amount changes based on the age of your. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

Our calculator will give you the answer. Child Tax Credit amounts will be different for each family. By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes.

The two most significant changes impact the credit amount and. If your AFNI is under 32797 you get the maximum amount for each child. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

From April 2020 to December 2021 the US. 6997 per year 58308 per month 6 to 17 years of age. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of.

New 2021 Child Tax Credit and advance payment details. The amount changes to 3000 total for each child ages six through 17 or 250 per. The credit amounts will increase for many.

The maximum child tax credit amount will decrease in 2022. Advance Child Tax Credit. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

The amount of credit you receive is based. Government made three separate direct COVID-19 stimulus payments to Americans totaling 931 billion. The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021.

That comes out to 300 per month through the end of 2021 and 1800 at tax time next year. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600. It will not be reduced.

The tool below is to only be used to help. Big changes were made to the child tax credit for the 2021 tax year. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if.

13 opt out by Aug. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Citizens with income below 75000 or married couples with an income below 150000 were eligible for all three payments and the full amount of each.

A childs age determines the amount. Under 6 years of age.

Child Tax Credit Payments What S Next

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

Child Tax Credit Payments What S Next

What Is The Child Tax Credit Tax Policy Center

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

Child Tax Credit Payments What S Next

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Pros Cons Of Advanced Payments Of The Child Tax Credit Cn2 News

Wtform Child Tax Credit Letter 6419 Explained Youtube

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Here S What You Need To Know About The Monthly Child Tax Credit Payments New Hampshire Bulletin

What Is The Child Tax Credit And How Much Of It Is Refundable

What To Know About The New Monthly Child Tax Credit Payments

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Monday Is Last Day To Sign Up For Child Tax Credit If You Have Not Received Payments In The Last Six Months

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

I Got My Refund Ctc Portal Updated With Payments Facebook

Advance Child Tax Credit Payments Begin July 15

Check Advance Child Tax Credit Economic Impact Payments On 2021 Tax Returns

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back